David Ellison describes Tom Cruise’s support for the Skydance-Paramount merger as “remarkable and humble,” and he calls the outreach from Hollywood

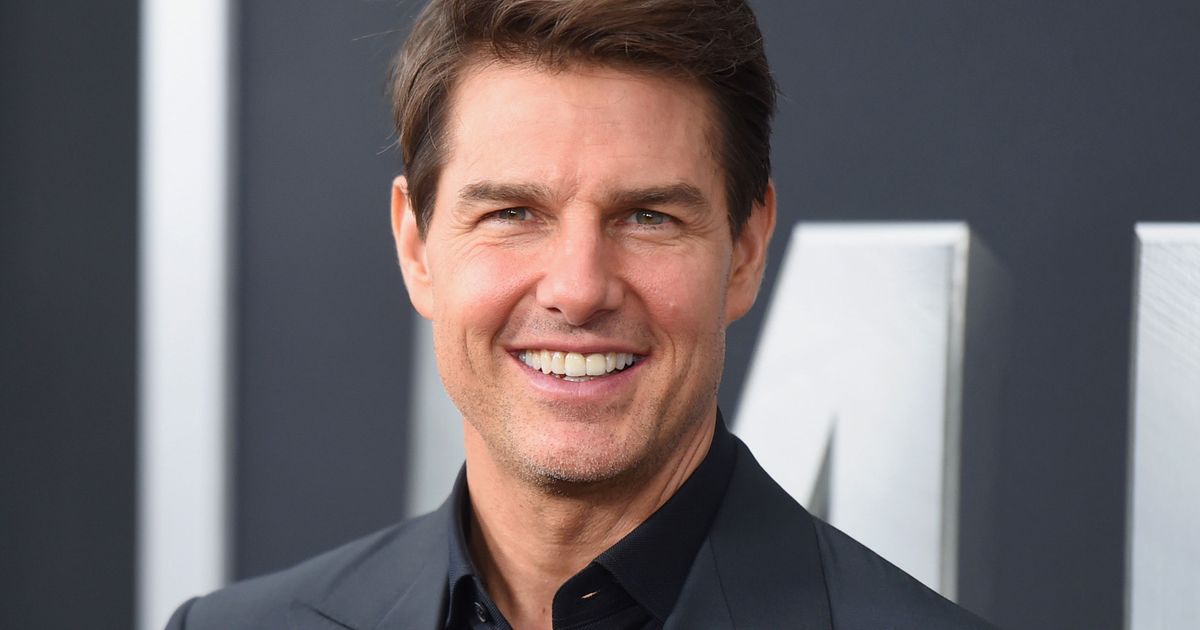

Tom Cruise, star of the Paramount films Mission Impossible and Top Gun, “is supportive of the planned merger,” according to Skydance CEO David Ellison, adding that the “outreach that we have received from the entertainment community has been pretty remarkable and humbling.”

“We will have one of the first owned and operated studios, which will be stable and able to look long term, so I think that’s a tremendous potential. That can concentrate on several years from now rather than just tomorrow. We genuinely intend to approach this business with a long-term perspective. And the fact that the world’s best filmmakers and artists are in favor of this deal has been incredibly thrilling, inspiring, and humble, he remarked in a CNBC interview today.

According to him, Skydance has produced nine films starring Cruise, referring to the actor as “one of the greatest, most talented artists in the world.”

In addition, Ellison gave the network a glimpse into his family’s investment philosophies and how they influenced the transaction on his end, saying, “We’re really comfortable with businesses in transition.”

“I believe that when you consider our family’s technological prowess and the recent change Oracle underwent, that was a period in which… we increased our stock purchases and came out of that transition stronger than ever. Recall similar discussions we had as a family, obviously, about Tesla at the time we placed that wager. And at Paramount, we firmly think that we can transform our company, build on our fundamental skills, make technological investments, and genuinely establish the media company of the future—one in which technology and art can coexist harmoniously. And think that Paramount will unquestionably win this when it’s all over.

The millionaire co-founder of Oracle and Ellison’s father, Larry Ellison, supports Skydance’s proposed two-step acquisition and merger with Paramount.

In response to a question concerning Larry Ellison’s potential role in the so-called New Paramount, which has everyone from Wall Street to Hollywood interested, he stated, “So obviously, you know, I’m running the company with Jeff Shell.” But please know that my father and I get along really well. We communicate every day.

When pressed on it, he conceded that there were certain matters “in this interim period I can’t speak to” and mentioned the collaboration between Oracle and Skydance to establish “studio in the could,” a cloud-based animation studio.

“Being able to learn from him and other mentors like Steve Jobs and David Geffen has been an amazing privilege.”

“What I really want to say is that fifteen years ago, when Skydance first started, the central tenet of its foundation was that a bridge between Silicon Valley and Hollywood would be built, and that this would cause a great deal of disruption.” Furthermore, Skydance is primarily a pure play content engine that spearheaded that disruption and has faith in the future of entertainment. And in all honesty, Paramount is a company that must change along with it in order to survive at this specific time.

Before reaching an agreement and making an announcement about a potential sale on Sunday night, Skydance and Shari Redstone, the controlling shareholder of Paramount, danced around a deal for several months. After that, a 45-day “go shop” period began, during which time any other potential bidder could decide to proceed. If not, authorities should easily approve the deal, and it might close earlier than the nine months that were predicted earlier this week.

Gerry Cardinale of RedBird Capital, Skydance’s partner and transaction investor, said, “There could be a pathway here for this to be a lot tighter and quicker in the review process, but it’s not in our control,” during an appearance with Ellison on CNBC.

The agreement calls for Shari Redstone’s family holding business, National Amusements, to be acquired by Skydance and backers including RedBird and Larry Ellison. National Amusements owns Paramount. The legendary corporation Paramount will see a $1.5 billion investment and merger from the Skydance group. Skydance is willing to buy out all Class A voting shares for $23 each and a portion of the non-voting Class B shares for $15. Paramount is a publicly traded company.

Hollywood is pleased that Par’s new owner is enthusiastic about the company, that the historic backlot will be protected, and that private equity—which has a history of destroying value—won’t have unchecked power. The fact that Ellison revealed an undisclosed but enormous $2 billion in cost savings compared to the $500 million in cuts this spring that the three departing CEOs identified—which is included in the total—may make Paramount staff members more nervous. Over the past year, industry sources have pointed out that Paramount has already been sliced quite thin.

The only thing that is currently known about the combined company’s management is that Ellison will serve as president and Jeff Shell as CEO.

Leave a Reply